The Crude Reality

Amidst the chaotic backdrop of global uncertainties, oil prices have found a surprising stability. In early Asian trading, oil prices inched higher, maintaining a steady increase that has become a trend in the past few months. This stability is largely attributed to the balance in supply and demand.

The Numbers

According to data from the U.S. Energy Information Administration (EIA), both Brent and West Texas Intermediate (WTI) crude oils have seen a modest but steady increase. As of this writing, Brent crude is trading at $75.12 per barrel, while WTI is trading at $71.87 per barrel. This stability, in an industry known for its volatility, is a refreshing change for traders.

Supply and Demand Dynamics

One of the primary reasons for this stability is the balance in supply and demand. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, have been meticulously managing the oil output to ensure that supply doesn’t outstrip demand. In a recent meeting, OPEC+ agreed to stick to their plan of gradually increasing output, an indication of their confidence in the current market dynamics.

On the demand side, recovery from the COVID-19 pandemic in many parts of the world has seen a resurgence in oil consumption. As economies reopen, industries restart, and travel restrictions ease, the demand for oil is expected to remain robust.

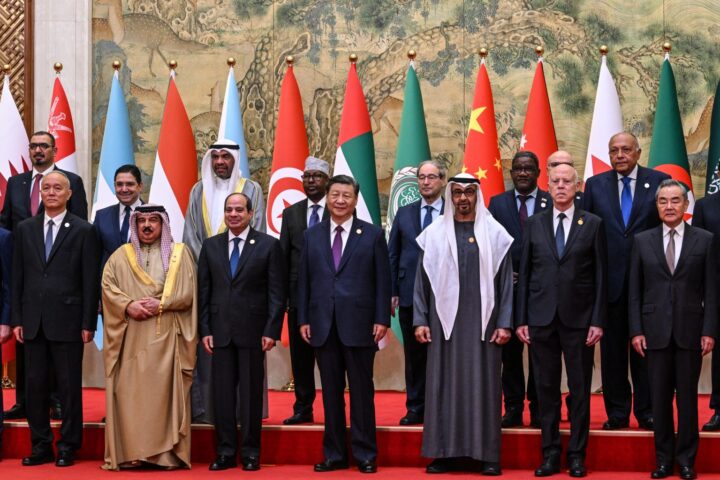

Geopolitical Stability

Looking Ahead

As we approach 2025, several factors are set to shape oil prices. Analysts at J.P. Morgan project Brent crude to average approximately $73 per barrel in 2025, with potential fluctuations driven by global economic conditions and geopolitical developments.

The global shift towards renewable energy continues to gain momentum. As countries invest more in cleaner energy sources, long-term demand for oil may decrease, potentially exerting downward pressure on prices.

OPEC+ production policies will also play a significant role. The group has extended oil production cuts through December 2024 to ensure market stability. Any future adjustments to these policies could significantly impact oil prices.